- Notifications

We will only notify the newest and revelant news to you.

Singapore is now the world's fourth-largest international financial center, behind New York, London, and Hong Kong, according to the 2018 Global Financial Centers Index (GFCI) study. Establishing a BVI company bank account in Singapore offers numerous strategic advantages for entrepreneurs and businesses alike. This article examines the intricacies of this process, exploring the steps involved, the associated benefits, and the financial considerations.

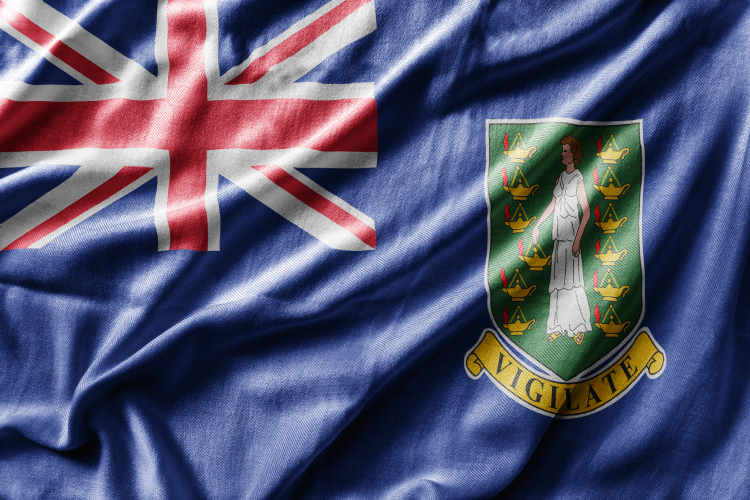

Nestled in the heart of the Caribbean, the British Virgin Islands (BVI) is renowned not only for its stunning natural beauty but also for its thriving economy and robust financial sector. As a premier offshore financial center, the BVI offers a myriad of investment opportunities for individuals and businesses seeking to capitalize on its favorable business environment, strategic location, and attractive tax regime.

The British Virgin Islands (BVI) possesses a well-regulated financial services sector, overseen by the BVI Financial Services Commission. This regulatory supervision encompasses various financial activities, such as banking and insurance, ensuring the industry's integrity and stability.

BVI company bank account in Singapore

The BVI's global standing as a leader in international finance can be attributed, in part, to the enactment of the International Business Company Act in 1984. This legislation has cemented the BVI's status as a significant international financial hub, attracting businesses worldwide. Regarding banking, the BVI exercises stringent control over bank licensing. Consequently, the jurisdiction currently hosts six commercial banks and one restricted licensed bank.

With 5 compelling reasons you can consider to open a company bank account, they include:

While many jurisdictions share common advantages such as the use of the English language, absence of currency exchange controls, and adoption of the US dollar as currency. Here are 14 benefits of setting up a BVI company:

Setting up a BVI company in Singapore is a straightforward process that combines the advantages of both jurisdictions. The first step is to engage a reputable corporate service provider with expertise in offshore company incorporation. They will guide you through the necessary steps while ensuring compliance with local rules and regulations.

Setting up a BVI company in Singapore

To begin setting up your BVI company in Singapore, Singaporean residents can contact our office via various communication channels, including email, phone, website, or by clicking the following link: https://www.oneibc.com/sg/en. Our experienced advisory team will assist you in selecting the appropriate type of British Virgin Islands (BVI) company for your business activities. They will also verify the eligibility of your preferred company name and provide information on the United Kingdom's obligations, taxation policies, and financial year.

Choose the most suitable entity type for your business objectives and consider opting for recommended services for your BVI company. These services may include:

Our team will help you understand the benefits and relevance of each service option to ensure they meet your specific requirements.

You can move on with the payment procedure when you have completed your choices and the services you want to use.. Upon completion of the payment, you will gain ownership of your chosen BVI company, enabling you to confidently commence your business operations.

In summary, the process of establishing a BVI company in Singapore involves three key steps. Initially, our advisory team assists with preparation, including selecting an appropriate BVI company type and providing essential information. The second step entails choosing desired services tailored to your business needs. The third and last step is to pay the required amount to formally create and acquire your chosen BVI business.

The expenses associated with establishing a BVI company in Singapore are influenced by various factors, including professional fees, government charges, and continuous maintenance costs. It is crucial to collaborate with a reliable corporate service provider who can offer a clear breakdown of these expenses. Generally, the BVI company setup cost in Singapore may include:

Consulting with a reputable corporate service provider will provide a detailed breakdown of the costs specific to your BVI company setup in Singapore. They can help you navigate the procedure and guarantee that all applicable laws are followed.

In conclusion, setting up a BVI company bank account in Singapore offers a compelling proposition for entrepreneurs seeking to expand their global footprint and optimize their business operations. By leveraging the advantages of Singapore's robust regulatory framework and the tax efficiency of a BVI company structure, businesses can unlock new opportunities for growth and prosperity in the dynamic landscape of international business. With careful planning, strategic execution, and the guidance of experienced professionals, entrepreneurs can embark on a journey of success and achieve their business objectives with confidence.

Latest news & insights from around the world brought to you by One IBC's experts

We are always proud of being an experienced Financial and Corporate Services provider in the international market. We provide the best and most competitive value to you as valued customers to transform your goals into a solution with a clear action plan. Our Solution, Your Success.