Offshore Company in Hong Kong

International Finance Center

Simple tax system

We will only notify the newest and revelant news to you.

Whether you are doing business in Europe, Asia, Africa, the Middle East, the Americas or elsewhere, One IBC® Group will set up the best trading or holding structure for your business in line with local laws and regulations.

International Finance Center

Simple tax system

Financial center in Southeast Asia

Free income tax for the Holding company

Leading maritime business activities

No minimum capital required

Stable political and economical system

Corporate income tax exemption

Economic center in Asia

Friendly and transparent business environment

Infrastructure highly develop

Tax exemption and non-financial reporting required

Member of many commercial institutions

The most dynamic emerging economy

Low corporate tax rates

Business infrastructure developed

Tax exemption for foreign companies

Excellent communication system and infrastructure

Open economy policies

Gateway to EU/EEA and Switzerland markets

Highest labor productivity in the world

2st in the world about global logistics capabilities

A modern legal system

Transportation and logistics hub

Concentration of large financial institutions

Comprehensive protection policy

Liberal tax system

Head office of multinational firms

Gateway to access Europe markets

Global financial service center

Stable political system

Flexible corporate management structure

Leading banking sectors

No corporation tax for offshore corporate

Tax-exempted on profits and capital gains

Highly confidential information

International financial center

High-level information security

One of the international business center

The fastest-growing economy in Central America

Tax-free, no exchange control

A wide network of international banks

Starting small and reaping big rewards

Increasing income and gaining wealth

Exemption from income tax on profits

Leading position for foreign investment

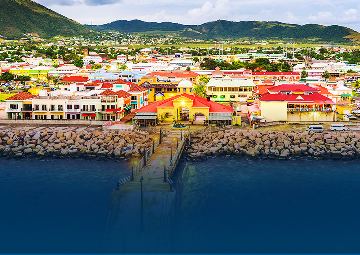

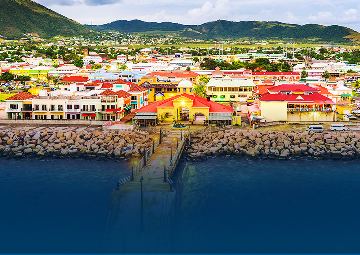

The economy prospered in the Caribbean

Perfect place for managing yachts and ships

One of the world’s largest logistics hubs

Leading host for global foreign investment

One of the fastest-growing economy

Free and open business environment

Variety incentive tax policies

Secured asset protection

Asset protection from a foreign corporation.

Better banking infrastructure.

See more jurisdiction we offer in the Asia Pacific and choose your favorite jurisdiction

International Finance Center

Simple tax system

Financial center in Southeast Asia

Free income tax for the Holding company

Leading maritime business activities

No minimum capital required

Stable political and economical system

Corporate income tax exemption

Economic center in Asia

Friendly and transparent business environment

Infrastructure highly develop

Tax exemption and non-financial reporting required

Member of many commercial institutions

The most dynamic emerging economy

See more jurisdiction we offer in the Europe and choose your favorite jurisdiction

Low corporate tax rates

Business infrastructure developed

Tax exemption for foreign companies

Excellent communication system and infrastructure

Open economy policies

Gateway to EU/EEA and Switzerland markets

Highest labor productivity in the world

2st in the world about global logistics capabilities

A modern legal system

Transportation and logistics hub

Concentration of large financial institutions

Comprehensive protection policy

Liberal tax system

Head office of multinational firms

Gateway to access Europe markets

Global financial service center

See more jurisdiction we offer in the Caribbean and choose your favorite jurisdiction

Stable political system

Flexible corporate management structure

Leading banking sectors

No corporation tax for offshore corporate

Tax-exempted on profits and capital gains

Highly confidential information

International financial center

High-level information security

One of the international business center

The fastest-growing economy in Central America

Tax-free, no exchange control

A wide network of international banks

Starting small and reaping big rewards

Increasing income and gaining wealth

Exemption from income tax on profits

Leading position for foreign investment

The economy prospered in the Caribbean

Perfect place for managing yachts and ships

See more jurisdiction we offer in the Middle East and choose your favorite jurisdiction

One of the world’s largest logistics hubs

Leading host for global foreign investment

See more jurisdiction we offer in the Africa and choose your favorite jurisdiction

One of the fastest-growing economy

Free and open business environment

Variety incentive tax policies

Secured asset protection

See more jurisdiction we offer in the America and choose your favorite jurisdiction

Asset protection from a foreign corporation.

Better banking infrastructure.

From

US$ 519

![]() 2 mins video Offshore Company has total exemption/low tax. In most jurisdictions/countries, no filing of accounts or submitting of annual returns is required after the offshore company has been incorporated. You can set up an offshore company in many jurisdictions, in many regions around the world, with no restriction based on your nationality, Many banks all over the world allow you to open a bank account for your offshore company and then do business internationally. The laws of almost all jurisdictions/countries we offer protect the confidentiality of the shareholders, directors and offshore company.

2 mins video Offshore Company has total exemption/low tax. In most jurisdictions/countries, no filing of accounts or submitting of annual returns is required after the offshore company has been incorporated. You can set up an offshore company in many jurisdictions, in many regions around the world, with no restriction based on your nationality, Many banks all over the world allow you to open a bank account for your offshore company and then do business internationally. The laws of almost all jurisdictions/countries we offer protect the confidentiality of the shareholders, directors and offshore company.

![]() Initially, our relationship managers will ask you to provide detailed information for all shareholders and directors, including their names. You can select the level of services you need. This stage normally takes one to three working days, or a working day in urgent cases. Furthermore, give the proposed company names so that we can check the eligibility of the names in each jurisdiction’s/country’s company registry/company house.

Initially, our relationship managers will ask you to provide detailed information for all shareholders and directors, including their names. You can select the level of services you need. This stage normally takes one to three working days, or a working day in urgent cases. Furthermore, give the proposed company names so that we can check the eligibility of the names in each jurisdiction’s/country’s company registry/company house.

![]() You settle the payment of our service fee and the official Government fee required for your selected jurisdiction/country. We accept payment by credit/debit card

You settle the payment of our service fee and the official Government fee required for your selected jurisdiction/country. We accept payment by credit/debit card ![]()

![]()

![]()

![]() , Paypal

, Paypal ![]() or by wire transfer to our HSBC bank account.

or by wire transfer to our HSBC bank account. ![]() (Payment Guidelines).

(Payment Guidelines).

See more: Company registration fees

![]() After collecting full information from you, One IBC® Group will send you digital versions of your corporate documents (certificate of incorporation, register of shareholders/directors, share certificate, memorandum and articles of association etc) via email. The full Offshore Company kit will be couriered to your residential address by express delivery (TNT, DHL or UPS etc).

After collecting full information from you, One IBC® Group will send you digital versions of your corporate documents (certificate of incorporation, register of shareholders/directors, share certificate, memorandum and articles of association etc) via email. The full Offshore Company kit will be couriered to your residential address by express delivery (TNT, DHL or UPS etc).

You can open an offshore bank account for your company in Europe, Hong Kong, Singapore or any other jurisdictions where we support offshore bank accounts! You have the freedom to make international money transfers from your offshore account.

Once your offshore company formation is completed. You are ready to do international business!

Fresh entrepreneurs oftentimes cannot tell the difference between a holding company and an investment company. While they do have a lot of similarities, holding companies and investment companies each have their distinct purposes.

A holding company is a parent business entity that holds the controlling stock or membership interests in its subsidiary companies. The cost to set up a holding company varies depending on the legal entity it is registered with, usually a corporation or an LLC. Large businesses usually set up a holding company because of multiple benefits it brings, including: Protecting assets, reducing risk and tax, no day-to-day management, etc.

An investment company, on the other hand, does not own or directly control any subsidiary companies, but rather is engaged in the business of investing in securities. Setting up an investment company is different from setting up a holding company, as they can mostly be formed as a mutual fund, a closed-ended fund, or a unit investment trusts (UIT). Furthermore, each type of investment company has its own versions, such as stock funds, bond funds, money market funds, index funds, interval funds, and exchange-traded funds (ETFs).

Selecting the best country in the Middle East to start a business can depend on various factors including the industry, market access, regulatory environment, and economic stability. However, the United Arab Emirates (UAE) is widely regarded as one of the top destinations for starting a business in the region due to several reasons:

However, it's important to consider specific business needs and conduct thorough market research. Other countries like Israel, known for its vibrant tech startup ecosystem, and Saudi Arabia, with its large domestic market and ongoing economic reforms under Vision 2030, also offer substantial business opportunities depending on the sector and business model. Each country has unique advantages and challenges, and the best choice depends on the specific dynamics of the business you intend to start.

As of 2023, the best five economies in Asia by GDP (Net Household Item) are typically:

These rankings can shift based on the measurements utilized, such as ostensible GDP or acquiring control equality (PPP), and financial conditions can cause shifts in these standings over time.

Asia is a landmass with a differing extend of financial frameworks, reflecting its wide assortment of societies, levels of improvement, and authentic foundations. Here are the four major sorts of financial frameworks found in Asian countries:

These frameworks reflect the financial differing qualities of Asia, from exceedingly created economies to those still joining conventional hones into their financial systems. Each framework has its claim set of points of interest and challenges that impact the region's improvement and integration into the worldwide economy.

Asia's economy is different and energetic, enveloping a run of profoundly created, quickly developing, and less created economies. Here's a more nuanced view:

Overall, Asia's financial scene is characterized by a blend of develop, fast-growing, and creating economies, making it one of the most financially dynamic districts universally. The continent's financial future looks promising, in spite of the fact that it will require tending to various social, political, and natural challenges to maintain development and progress living benchmarks over all countries.

Myanmar, regularly respected as a nation with a complex and challenging financial scene, has considerable potential due to its wealthy normal assets and key area between China and India, two of the world's biggest markets. Here are a few key angles of Myanmar's economy:

Overall, Myanmar's economy is stamped by critical potential and similarly critical challenges. Its future financial direction will generally depend on its political scene and how it oversees its endless characteristic assets and human capital.

As of 2023, the Affiliation of Southeast Asian Countries (ASEAN) is undoubtedly frequently alluded to as the sixth-largest economy in the world when considered collectively. This bunch incorporates ten nations: Indonesia, Malaysia, the Philippines, Singapore, Thailand, Brunei, Vietnam, Laos, Myanmar, and Cambodia. These countries together frame a critical financial coalition with a differing financial base, extending from exceedingly created economies like Singapore to quickly developing ones like Vietnam and Indonesia.

ASEAN's combined GDP places it among the world's biggest economies, much obliged to its considerable populace, vital area, and developing integration into the worldwide economy through exchange, speculation, and participation. The financial quality of ASEAN too benefits from its statistic points of interest, counting a youthful and developing workforce that pulls in both outside coordinate venture and multinational trade operations.

October of 2022 has become a successful month for One IBC Grouporation (OCC) as we have partnered with SAP - world’s leading business management software producer - to streamline operations and improve our services.

In order to thank you for the long ride we've had over the past time, One IBC® would like to bring you an exclusive OCTOBER SALE - Seasonal packages for those who wish to open an offshore company in Seychelles.

There are four rank levels of ONE IBC® membership. Advance through three elite ranks when you meet qualifying criteria. Enjoy elevated rewards and experiences throughout your journey. Explore the benefits for all levels. Earn and redeem credit points for our services.

Earning points

Earn Credit Points on qualifying purchasing of services. You’ll earn credit Points for every eligible U.S. dollar spent.

Using points

Spend credit points directly for your invoice. 100 credit points = 1 USD.

Referral Program

Partnership Program

We cover the market with an ever-growing network of business and professional partners that we actively support in terms of professional support, sales, and marketing.